AI’s stock market shakeup fuels dispersion trading craze

This year’s sharp rotation in global stock markets is encouraging more investors to pile into dispersion trades, a complex breed of derivatives that profit from share prices heading in different directions.

Dispersion is gaining traction with investors including pension funds, asset managers and family offices, broadening the range of clients, bankers say, engaging in these sophisticated strategies that were once the preserve of specialist hedge funds.

That comes as AI breakthroughs have triggered a plunge in the shares of companies considered most at risk of becoming obsolete – and a rally in those seen as beneficiaries of the AI boom, or at least a haven during the storm.

The dramatic stock market churn has sent dispersion surging to its highest level on record in the US, according to UBS, citing the difference in average realised volatility between single stocks and the S&P 500. Those dynamics have minted meaty profits for dispersion traders already this year, while also stoking demand from new investors eager to get in on the action.

“The dispersion that we’ve seen in markets over the last few weeks is almost unprecedented,” said Kieran Diamond, derivatives strategist at UBS. “This is the perfect environment for long stock and short index vol trading … Hedge funds are probably the most persistent participants in that trade, but we see growing family office flow and broader institutional participation.”

Dispersion trades can assume a variety of different flavours but typically involve taking a short volatility position on an index like the S&P 500 by selling options, while simultaneously taking a long volatility position on a group of individual stocks in that index by buying options. That bet can pay off handsomely if the individual stocks prove more volatile than the broader index, which increases the value of the single stock options they've bought compared to the index options they've sold.

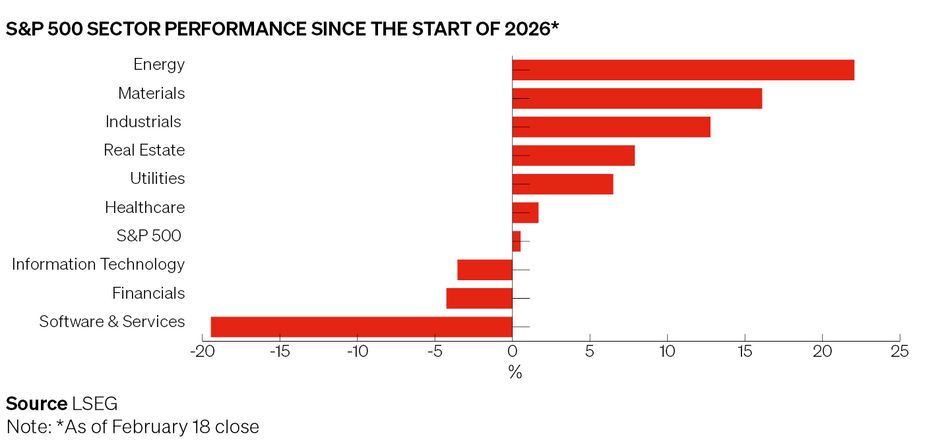

The first few weeks of 2026 have provided an ideal backdrop for these strategies. AI company Anthropic’s launch of new AI tools have sent software and other IT services stocks into a tailspin as investors have scrambled to assess the impact of this groundbreaking technology on companies that provide software, marketing, legal and finance services. The S&P Software & Services Select Industry Index is now down almost 20% this year.

Other sectors have flourished in the meantime as investors have dialled down their exposure to tech stocks in favour of more defensive holdings – or attempted to identify companies that could benefit from the AI disruption. The S&P 500’s consumer staples subindex is up 13% this year, while the energy subindex has jumped 22%.

These contrasting fortunes have also kept the S&P 500 more or less flat so far in 2026 – resulting in a bumper payday for dispersion traders.

“There is a lot of dispersion in the market right now, owing to the fact that there’s a lot of chatter about the beneficiaries and losers of AI,” said a senior equity derivatives trader at a major bank. “We’ve been trading dispersion with clients more so this year than last year, that’s for sure. In terms of P&L, this year has also been much better than last year so far.”

Hedging on the rise

Historically, the difficulty in designing and implementing these complex derivatives strategies meant that they remained out of reach for most investors other than specialist hedge funds. In recent years, though, banks have invested heavily to bring dispersion to a wider audience.

Banks have developed and sold huge volumes of ready-made “quantitative investment strategies” that allow investors to gain exposure to dispersion through off-the-shelf products – some of which they can tailor depending on their exact requirements. That has encouraged a wider array of hedge funds to trade dispersion. It has also opened the door to investors that may have previously considered dispersion as too exotic or fiddly to trade.

Aruna Tatavarty, head of QIS for EMEA at Citigroup, said the bank has recently seen fresh inflows to dispersion strategies that have performed well this year. That includes a growing number of clients looking to use dispersion as hedges for their investment portfolios.

The “carry” profile of dispersion strategies (the returns or costs that come from holding an investment) can be attractive compared to more straightforward hedges such as buying downside protection on the S&P 500, analysts say. That’s because dispersion involves owning single stock protection while selling index protection – a construction that can allow investors to benefit from a rise in market volatility.

"We have seen inflows from across the globe and from different types of clients like asset owners and asset managers, even hedge funds and family offices,” said Tatavarty. “A wide range of clients are looking to hedge themselves in a way that doesn’t carry poorly and they’ve been rewarded well so far this year given multiple tech company announcements and sector rotations.”

“Vega-neutral” strategies, which achieve better levels of carry through selling more index volatility, have been the most popular form of these trades recently, said Tatavarty. The strategy has similarly attracted new investors such as pension funds and asset managers of late, said Julien Turc, head of BNP Paribas' QIS lab.

“An increasingly diverse range of market participants are looking for strategies that can protect their portfolio in case of market turmoil and dispersion is one of the most attractive strategies available,” said Turc.

Risky business?

While today’s extreme level of dispersion has attracted more investors, it’s also caused disquiet in some corners. The main risk to these strategies is market correlations start to drift higher again or a systemic shock that causes stocks across the board to plunge.

Garrett DeSimone, head of quantitative research at data provider OptionMetrics, said that because correlation is currently low and single name volatility is elevated, dispersion trades are “meaningfully riskier” than in the past. “The biggest concern for dispersion trades right now is that you get some kind of macro event which pushes all of these correlations to one,” he said.

Rock-bottom correlation levels have already prompted some hedge funds to look at “reverse dispersion” trades that benefit from stocks starting to move in sync again. Diamond said only a few investors have put those trades into practice, though, because of the costs of holding the position.

“Ultimately, reverse dispersion is a strategy which needs to be timed incredibly well given the fact that spikes in index volatility and correlation can be so short lived,” he said. “It’s not an easy trade to time or monetise, even though it’s an interesting one to consider given that current dislocations aren’t sustainable.”

However, there are also many who believe that high levels of dispersion are here to stay. Analysts are only just beginning to understand how AI will disrupt companies across the global economy. Even the impact on the most beaten-down sectors such as software is still hotly contested.

Moreover, there’s every reason to believe that further advances in AI will send shockwaves through other industries in the months ahead – and keep stock prices pinging all over the place.

“It doesn’t seem likely that this AI story will be concluding any time soon and will instead continue to impact different regions and sectors, continuing to encourage dispersion trading,” said the equity derivatives trader.