Allianz preps RT1 return as FIG supply gathers pace

European financial institutions' issuance activity gathered pace on Monday as investors greeted green-labelled unsecured supply and the first euro benchmark covered bonds following the market's summer break, while Allianz prepared to sell a rare US dollar-denominated Restricted Tier 1 in an important refinancing transaction.

Tariff turmoil fuels bumper payday for inflation traders

Banks’ inflation trading desks have enjoyed their strongest start to a year since 2022’s once-in-a-generation surge in consumer prices, as concerns over the impact of US tariffs have triggered a flurry of activity in this niche corner of financial markets.

Banks’ inflation trading desks have enjoyed their strongest start to a year since 2022’s once-in-a-generation surge in consumer prices, as concerns over the impact of US tariffs have triggered a flurry of activity in this niche corner of financial markets.

M&A bankers entered 2025 with big expectations that it would be a banner year for dealmaking. After a rocky start, the year is now shaping up to be decent – with sellers coming to market and buyers opening their wallets.

A growing number of corporate borrowers are taking advantage of widespread expectations of looming US interest rate cuts to lock in their borrowing costs on future debt sales ahead of time.

European financial institutions' issuance activity gathered pace on Monday as investors greeted green-labelled unsecured supply and the first euro benchmark covered bonds following the market's summer break, while Allianz prepared to sell a rare US dollar-denominated Restricted Tier 1 in an important refinancing transaction.

The public sector bond market is back in full force, with some of the biggest borrowers set to reboot supply in both euros and dollars this week.

Caterpillar Financial Services reopened the euro investment-grade market on Monday with a €600m three-year issuance, the first such deal since Wendel 's on August 5.

Casino operator Wynn Macau (B1/BB–/BB–) returned to the US dollar bond market on Tuesday for the first time in five years with a US$1bn 8.5-year non-call three bond priced at par to yield 6.75%, inside initial price talk of 7%.

Data center operator Vantage has wasted little time in returning to the asset-backed market following the solid reception of its last securitization earlier in August.

Barclays (arranger) and Bank of America refinanced Antigua Mortgages and Cheshire 2020-1 transactions into Cheshire 2025-1, a £260m UK RMBS issue, on August 11. The sponsor is Barclays Bank, which used its Isle of Wight Homes vehicle as the seller. All tranches were preplaced, tranches A–D with BofA's trading desk.

Non-QM issuers continue to target the RMBS market, taking advantage of favourable funding conditions and eager investors.

Domino's on Tuesday sold US$1bn of bonds to eager investors as the world's biggest pizza chain tapped the structured finance primary for the first time since 2021.

African countries are clamouring to follow the lead of Ivory Coast’s recent debt-for-development swap , according to one of the landmark World Bank-backed deal’s new money lenders.

The European Central Bank's move to make its collateral pool green will put a price on climate transition risk for the first time, although some market participants argue that the central bank needs to go further.

Two years after slamming the sustainability-linked loan market for failing to achieve its potential , the UK Financial Conduct Authority is subsequently “encouraged by the progress we've seen”.

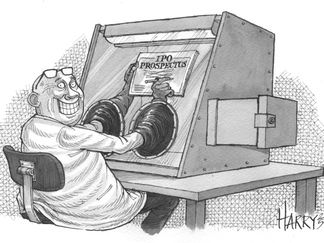

Gemini Space Station filed publicly for its Nasdaq IPO late Friday, joining a growing list of companies hoping to go public in September.

Legence filed late Friday for a Nasdaq IPO that would allow the Blackstone-backed industrial equipment supplier to begin marketing immediately after the September 1 US Labor Day holiday.

Spanish gaming company Cirsa Enterprises had to contend with its shares trading below issue price for nearly a month following its €453m IPO but shares are now up and banks have started to publish research rating the stock a buy.

Chinese biotech companies are flocking to raise funds in Hong Kong, attracted by friendly listing policies and surging share prices on the back of big licensing deals and a positive sector outlook.

Taiwan’s HD Renewable Energy is in talks with banks for debt financings to meet nearly A$3bn (US$1.95bn) in estimated costs for renewable energy and battery storage projects in Australia.

In a sign of the shifting landscape in private finance, asset managers such as Apollo, Blackstone and KKR are deepening their push into investment-grade private credit, targeting large, high-quality assets with bespoke lending structures.

UK-based distance and blended learning provider Arden University took advantage of reverse enquiries to bolt a sterling tranche on to the trade that will fund its partial acquisition by Brightstar Capital Partners from existing owner Global University Systems.

Ghana-focused Asante Gold Corp has lined up a financing package to unlock around US$500m of proceeds.

Healthcare products manufacturer QuidelOrtho has finalised a term loan B at wider-than-launch terms, reflecting investor hesitation over the company’s post-Covid-19 trajectory, according to a source.QuidelOrtho, which makes tests for a range of illnesses including those caused by coronavirus, has raised concerns among buyside participants as much of the world moves on from the pandemic that began in late 2019, an investor involved in the deal said.“The major hang-up is that this business was one of the Covid-19 beneficiaries, and now they’re trying to pivot,” the investor said. “The pushback is very specific to this credit, since they do rapid point-of-care testing, which was obviously huge a few years ago. Now they’re trying to transition into blood tests done at a primary care office instead of a lab, but if you look at their numbers, they’re down significantly from the peak in 2022.”Negative Ebitda growth has also weighed on sentiment. According to QuidelOrtho’s 2024 annual report, adjusted Ebitda for fiscal 2024 was US$892.1m, having fallen from US$1.025bn in 2023 and US$1.689bn in 2022. The company projects earnings to dip even further, with an estimated fiscal 2025 adjusted Ebitda of US$575m–$612m, according to its second-quarter 2025 results released on August 5.“The revenue they had a few years ago was a peak, and they’re not going to come back to that anytime soon. You can’t look at sales and Ebitda from a few years ago and call that a reasonable baseline for the company,” the investor said.In a market where supply/demand imbalances have fuelled upsized deals and tighter pricing, the reaction stands out as one of the few examples of buyside pushback, the investor added. “None of the hesitation keeps the deal from getting done — it just has to be a smaller size and wider terms.”The loan closed at US$1.45bn after being cut to US$1.4bn from US$1.5bn at launch. Pricing landed at 400bp over SOFR with a 98 OID, compared with initial guidance of 300bp–325bp over SOFR with a 99–99.5 OID.The seven-year facility has a 0% floor and 101 soft call protection for six months. Alongside concurrent revolver and term loan A facilities, proceeds will refinance existing debt. Bank of America is lead-left arranger.According to an August 6 S&P report, the concurrent TLA includes a US$1.1bn tranche and a US$100m delayed draw tranche, while the revolver totals US$700m. The company’s adjusted leverage was about five times for the 12 months ending June 30, the report said.An August 6 SEC filing showed approximately US$2.21bn outstanding on the company’s existing term loan, which originated at US$2.75bn, and US$390m outstanding on its US$800m revolver.

Read the latest stories from the magazine IFR 2596 - 16 Aug 2025 - 22 Aug 2025

16 Aug 2025 - 22 Aug 2025