SoftBank levers up to raise OpenAI stake as new US$100bn round nears

SoftBank Group sold some of its most profitable investments and took on billions of dollars of debt so that it could triple its bet on OpenAI at the end of last year, in an indication of how Masayoshi Son is increasingly tying his company’s fortunes to the success or failure of the AI outfit.

The Japanese investment giant sold its entire holdings in chipmaker Nvidia and phone operator Deutsche Telekom and cut its stake in T-Mobile US to raise US$10.1bn. It also pledged more shares in chip designer Arm Holdings and its SoftBank mobile business to secure an additional US$9.1bn in margin loans.

It tapped debt markets too, selling US$6.1bn in bonds and drawing down a US$6.5bn bridge loan as part a funding blitz during the October to December quarter that enabled SoftBank to participate in two OpenAI funding rounds that more than tripled its stake in the loss-making startup.

Son, who made much of his fortune as an early backer of Alibaba Group Holding, has now invested US$34.6bn in the ChatGPT operator through his company – up from US$10.8bn at the end of September – making it the third-largest investor with an 11% stake, behind OpenAI’s non-profit foundation and Microsoft.

“Masa is a gambler,” said one former SoftBank employee who worked on many of its Silicon Valley investments. “Once he decides he’s in, then he goes all in on these bets. There’s very little financial rigour to these investments. It’s all about gut feeling for him.”

Open-eyed

SoftBank's latest results, which were released on Thursday, offer a glimpse of the frenzied paddling going on beneath the surface to ensure the company does not breach its informal policy of keeping borrowing below 25% of the net asset value of its portfolio during “normal times”. The level has almost tripled over the last 18 months to 20.6% of NAV.

In a move that eased pressure on its informal debt policy, SoftBank marked up its OpenAI investment by US$4.2bn in the latest quarter – following a US$14.6bn markup the previous quarter. It now values its 11% stake in OpenAI at US$54.4bn, which accounts for about 27% of SoftBank's total NAV.

SoftBank is reported to be looking to inject another US$30bn into OpenAI as part of the company's US$100bn fundraising round. It has already begun talks with banks to borrow US$10bn or more – although a loan of that size could push it over its leverage threshold.

As an alternative source of cash, Son could sell more of the company's US$30bn portfolio of listed equities, but such a move would leave SoftBank even more exposed to the AI startup. It may also write up its OpenAI stake further to offset the rise in debt.

“I understand there are financing plans by OpenAI … but nothing has been decided,” said chief financial officer Yoshimitsu Goto during a press conference following the results. He stressed that, while the debt policy was not a strict covenant, SoftBank would tread carefully.

“If you only think about financing, there are many options,” he said. “But it doesn’t mean you should invest in anything just because you can finance or raise money. I believe we do need to focus on whether we can retain the soundness of our financials as a company.”

Blurred vision

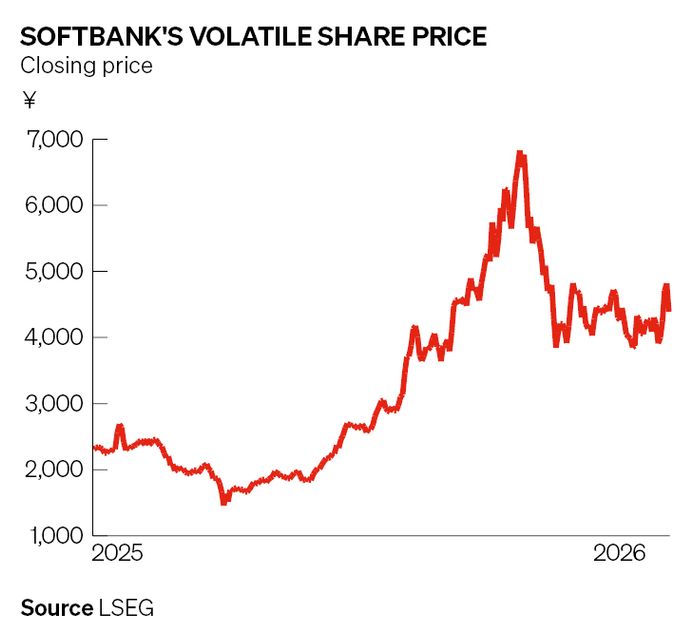

SoftBank’s share price has fluctuated wildly in recent months as sentiment has ebbed and flowed on the investment merits of AI. It sold off again on Friday, the day after results were announced, losing 8.9%, and has fallen by more than a third since October, valuing the company at ¥25trn (US$163bn) – well below its NAV of ¥30.9trn at the end of last year.

SoftBank's OpenAI investment sits in the company’s Vision Fund 2 portfolio, an US$85bn fund which launched in 2019. But the fund – alongside the original Vision Fund – has had a difficult few years, with large losses taken on bad investments in companies including WeWork and Wirecard.

As recently as six months ago, Vision Fund 2 was more than US$15bn under water. But the writeups on OpenAI and a handful of other investments mean that it is now – at least on paper – sitting on a US$1.1bn gain. The original US$40bn Vision Fund has posted gains of US$5.1bn.

While OpenAI is by far the largest, Vision Fund 2 has investments in 276 other companies. Two Indian companies that form part of the Vision Fund 2 portfolio went public in the final three months of last year: eyewear company Lenskart Solutions raised Rs72.8bn (US$830m), while e-commerce platform Meesho raised Rs54bn.

SoftBank listed 16 companies across its two Vision funds and separate LatAm fund – including OpenAI – as “late-stage” private companies that could go public soon.

Separately, Anthropic – one of the main competitors to OpenAI – said it raised US$30bn from investors in its latest Series G funding round, in a deal that values the startup at US$380bn.

The company, which was set up five years ago by a group of OpenAI employees who left the company after disagreements over safety and governance, said the round was led by Singapore sovereign wealth fund GIC and investment manager Coatue, one of the so-called Tiger Cubs.

Anthropic said it is now booking revenues at a run-rate of US$14bn. It earned its first dollar three years ago and has grown revenue by a factor of 10 in every year since.