OpenAI faces financial crunch point as huge supplier bills start to come due

OpenAI is facing a US$20bn black hole in its accounts this year, as a series of buy now, pay later deals struck with suppliers including Nvidia, Oracle and CoreWeave start to come due, putting the startup under acute pressure to find new, deep-pocketed investors to secure its future.

The shortfall estimate is based on information shared with IFR by investment banks that asked not to be identified because they are actively engaged in pitching OpenAI for work. It sets up 2026 as a make-or-break moment for the AI giant, and raises questions about whether OpenAI might possibly buckle under the sheer weight of the financial commitments it has made.

With revenues just a fraction of its rising costs, the situation is likely to become much worse, with the projected hole in its finances growing to about US$130bn over the next two years – positioning OpenAI for a series of financial crunch points.

“People think we’re running an experiment about an amazing technology, but we’re also running an experiment about the depth of capital markets,” said Sebastian Mallaby, senior fellow at the Council on Foreign Relations and author of "The Infinity Machine", a new book about the AI race.

OpenAI has raised more than US$60bn since 2015, including US$41bn last year in a round led by SoftBank that was the largest ever seen. But it is set to burn through the last of that cash this year and with profitability still some years away, the question is whether investors are willing to bankroll the giant loss-making venture.

Last year's huge fundraising was "unprecedented in the history of capitalism”, said Mallaby. “But can it keep repeating that trick year after year? Honestly, we don't know. I would say that this year maybe they squeak through and next year they hit the wall. That would be my guess.”

Eye-watering

On the face of it, OpenAI is ahead in the race to be the leading AI player following the runaway success of its generative AI chatbot. After launching ChatGPT in 2022, the startup has amassed 800 million weekly active users, more than double the traffic of rival AIs developed by Facebook owner Meta Platforms and Google's parent Alphabet.

But the cost of staying in the race is proving eye-wateringly expensive. OpenAI plans to increase its current 1.9GW of compute to 36GW over the next eight years and has struck a series of deals to build data centres and buy cutting-edge chips, which together have saddled it with US$1.4trn of liabilities.

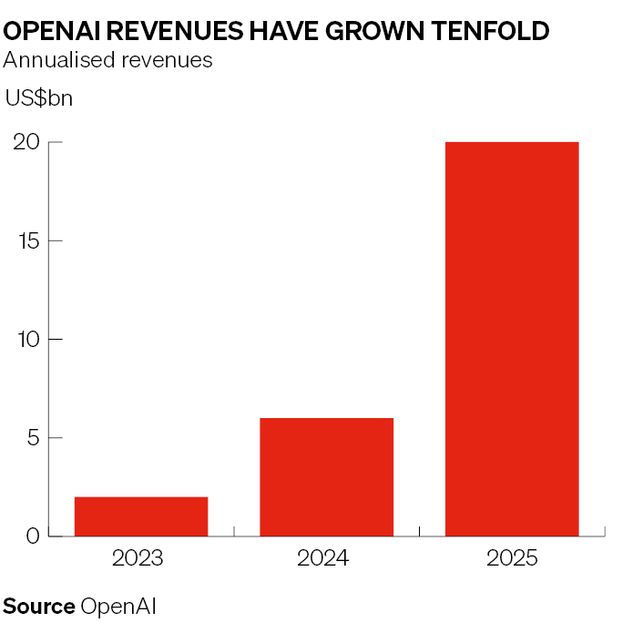

How a company with just US$20bn in revenues pays for that is the big question. Larger rivals like Alphabet and Meta have legacy businesses generating hundreds of billions of dollars a year that they can draw on. OpenAI, by contrast, can only survive for as long as its backers are willing to keep it afloat.

“These are very important questions right now,” said Gil Luria, head of technology research at West Coast boutique investment bank DA Davidson. “If OpenAI can’t raise the capital it needs, that will cement the fact that the only big winners from AI will be the largest mega caps.”

Until now, OpenAI chief executive and co-founder Sam Altman has managed to push its financial obligations out into the future through shrewd deals that saddle its suppliers with raising financing upfront, while OpenAI has been largely off the hook.

“Securing world-class compute requires commitments made years in advance,” OpenAI finance chief Sarah Friar wrote last week in a post on the company's website that celebrated hitting US$20bn in revenues – several months ahead of schedule. “At times, capacity leads usage. At other times, usage leads capacity.

“We manage that by keeping the balance sheet light, partnering rather than owning, and structuring contracts with flexibility across providers and hardware types. Capital is committed in tranches against real demand signals. That lets us lean forward when growth is there.”

Coming due

But there are signs that strategy is coming back to bite OpenAI. More than US$80bn of deferred commitments are set to come due this year, according to bank projections – including some linked to a deal last year to purchase US$250bn of compute from Microsoft.

With other contracts that OpenAI has taken out with data centres, cloud computing providers and chip manufacturers over the past few years also starting to come due, the company is facing a wall of payment demands that could amount to several hundred billion dollars between now and the end of 2030.

Renegotiating those contracts to reduce or push payments out may be tricky. Some suppliers have come under intense criticism from investors because of the risks they are taking on for this one client.

Oracle, for example, has had to rethink its debt strategy and is being sued by some bond investors, although last week it received lender commitments for the full US$38bn project finance package backing two data centres in what is the largest project finance loan in history.

“He's an unbelievable salesman – and, in a way, that's both his greatest strength and his potential downfall,” said Mallaby, referring to Altman's ability to get his suppliers to finance upfront the deals that are now coming due. “He’s such a good salesman that he’s got himself into this position.”

OpenAI says its revenues could reach US$200bn by 2030, but people close to the company said it is unlikely to consider raising debt to tide it over until it is in a better position, with one banker calling such an idea “totally unrealistic”.

The company is rumoured instead to be considering a US$100bn listing – possibly as early as this year. That would be more than three times larger than the biggest IPO ever seen: the US$29.4bn listing in 2019 of Saudi Aramco, which was generating more than US$1trn of oil revenues at the time.

“The alternative for OpenAI is to pursue an IPO, but that may take time and will have significant complexity as it would be one of the biggest IPOs of all time,” said Luria. “OpenAI’s enormous structural operating losses would further complicate such an issuance.

“OpenAI was only able to raise capital primarily from one investor – SoftBank – during its last fundraise, which is one signal that there are not a lot of investors that are willing to participate at this size,” said Luria, who added that hopes of Gulf money are “a supposition at this point”.

Legal complications

Altman has been touring the Middle East trying to convince investors to participate in US$50bn funding round, Bloomberg reported. OpenAI declined to comment about the solicitations – or about the projected shortfall this year, saying only that the bank estimates "aren't accurate".

Complicating matters is a lawsuit from Elon Musk, who is seeking US$109bn in damages from OpenAI over claims he was duped into making donations on the basis that OpenAI would remain a non-profit. The suit will be heard at a jury trial starting in a couple of months.

Musk is seeking damages from what he calls “ill-gotten gains” made by OpenAI when it entered a for-profit agreement with Microsoft to unlock US$10bn in funding. The agreement was concluded in October, giving Microsoft a 27% stake in OpenAI. Musk is also seeking US$25bn from Microsoft.

“I don't know what the smart interpretation is of Musk's chances of success, but if you thought that chances were anywhere near significant, then that would be a huge effective dilution of the stock,” said Mallaby, adding that any investors coming in now would seek a discount because of the risk.