Electronic revolution hits banks’ credit trading revenues

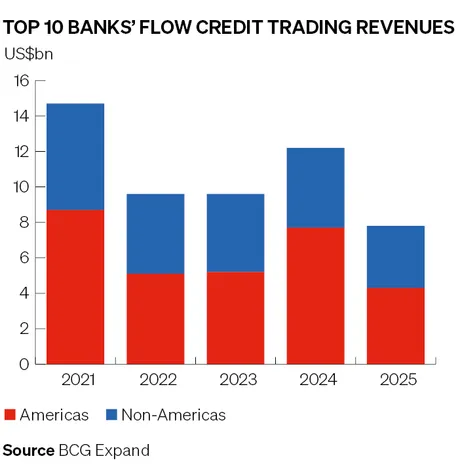

Banks’ corporate bond trading revenues have slumped to their lowest level in more than a decade, according to benchmarking firm BCG Expand, in the wake of a rapid electronification of these markets that is eroding the profitability of credit trading desks.

The top 10 banks generated US$4.3bn of revenues in North America “flow” credit trading in 2025, BCG Expand said, less than half their 2021 total. That comes amid a structural shift in the once human-centric world of corporate credit towards an equities-style trading paradigm in which machines process a larger share of transactions.

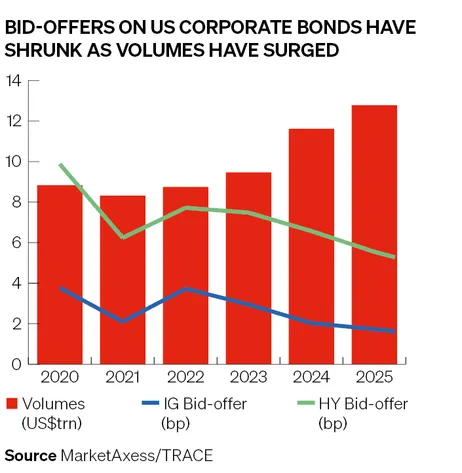

This electronic revolution has sent trading volumes soaring to record highs in the US$11.5trn US corporate bond market as investors have found it easier to shuffle positions. But it has also compressed trading margins to their skinniest levels in history, making it harder than ever for banks to turn a profit despite this surge in activity.

“The flow credit trading business has become increasingly competitive,” said Amrit Shahani, partner at BCG Expand. “This has made it challenging for all except the largest banks and nonbank liquidity providers active in this space. Smaller banks may find it harder to meet their return targets."

The decline in flow credit contrasts starkly with the record results that banks are registering in other parts of their trading operations. It follows an acceleration in the electronification of credit trading in recent years that many believe is changing the face of these markets for good.

The last bastion

For years, corporate bonds represented one of the last bastions of the human trader. Just 8% of US investment-grade transactions and 2% of high-yield trades were handled electronically in 2013, according to data provider Crisil Coalition Greenwich. But credit markets have evolved significantly since then with e-trading now accounting for about half of investment-grade and a third of high-yield transactions.

Giving investors the ability to trade on a screen, rather than having to pick up the phone, has also propelled volumes higher across the wider market. A record US$12.8trn of US corporate bonds changed hands last year, according to MarketAxess, a 54% rise from 2021.

Portfolio trading, in which investors buy and sell large blocks of securities in one go, has become a prominent feature of the market, accounting for 22% of US investment-grade volumes last year compared with 8% in 2023, according to Barclays. This increased ease of trading has been great news for investors and helped allay longstanding concerns over their ability to sell positions during periods of market stress.

“Credit was sometimes viewed as the last frontier as far as electronic trading was concerned. But we’ve seen electronification pick up significantly,” said Kate Finlayson, global head of FICC market structure and liquidity at JP Morgan. "In fact, other asset classes are now learning from credit because that's where we’ve seen a lot of the innovation and advancements."

The flipside for trading desks is a relentless contraction in bid-offer spreads – the gap between where traders offer to buy and sell securities, and a useful proxy for the profitability of bond trading. For US investment-grade bonds, the median bid-offer spread has more than halved since 2023 to 1.4bp, according to MarketAxess, while high-yield markets have also compressed considerably.

Margin squeeze

The resulting squeeze on margins has left little room for traders to eke out profits. It has also meant that those firms lacking the technology to churn large volumes and take down meaty portfolio trades risk falling behind.

“Volumes are up, but margins are down. Overall, for the Street that’s been a real challenge,” said Bob Douglass, managing director in credit trading at Barclays. “We’ve had to make huge investments. The barriers to entry to being a successful bond trading business are significant now."

These technological advancements are transforming the credit trading landscape in previously unthinkable ways. Historically, the largest debt underwriting banks dominated secondary trading thanks to their well-staffed salesforces and close relationships with bond investors. Now, technology has undercut those advantages and opened the door to nonbank trading firms.

Jane Street has become a major force in flow credit trading after leveraging its presence in exchange-traded funds. Citadel Securities has also made inroads since launching corporate bond trading in 2023. The marketmaker said it traded about US$500bn of corporate bonds last year.

“Credit markets are continuing to go through market structure shifts that we've seen in other asset classes. That evolution naturally reduces transaction costs, increases transparency and liquidity, benefiting clients and issuers,” said Sam Berberian, head of credit trading at Citadel Securities.

Franchise value

The pure marketmaking focus of firms like Citadel Securities represents a different proposition to traditional banks, many of which believe they still need bond trading to support their debt underwriting activities.

Bankers say this breadth in their operations is also a strength. For one thing, firms with complementary activities like underwriting, financing and derivatives trading should have more of a cushion to absorb the bond trading squeeze. Many also argue it helps them win business from the largest investment managers looking to deal with a one-stop shop.

“The [bid-offer] compression is very real, but it’s not a reason to panic. We can withstand it,” said the head of credit at a major bank, who predicted that spreads will keep tightening to the point where today's markets feel like a "golden age" for bid-offer.

“The reality is we need to have a secondary trading business. The top houses have the technology and the personnel to keep sharpening it and making it more efficient. But we’ve also got the capital markets piece, we have the derivatives piece, so we have many ways to access the client wallet."

Some bond veterans draw on banks’ experience in cash equities to predict where credit could be headed next despite important differences between the two markets, including retail investors' far heftier presence in share trading.

Traditional banks have lost market share in trading stocks over the past two decades. However, that did not stop them from posting record trading revenues in their equities divisions last year as other activities such as financing and derivatives have grown rapidly.

“In equities, it took time for the Street to make the adjustment from a high-touch model to a more electronified business model. A lot of people pulled back,” said Mike Daniel, head of flow credit and securitised products trading at Citigroup. "Now it’s the opposite: equities revenues are booming again and banks are investing in both trading and financing.”